Metals & Futures

Multi Asset.

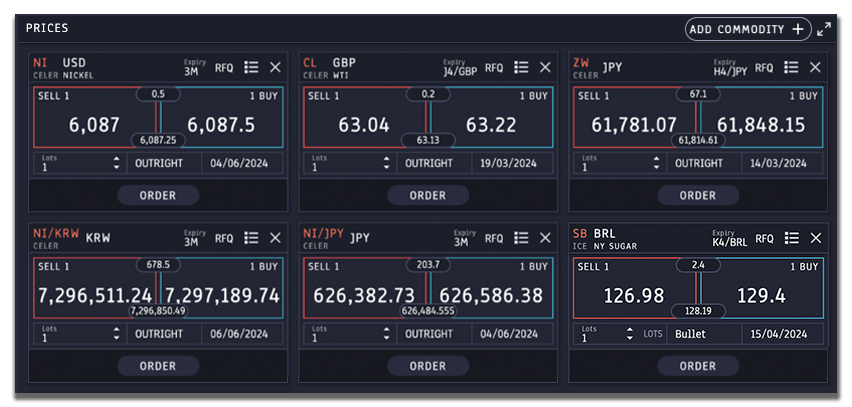

We are proud to add Metals & Futures to our wide spectrum of asset classes making us a true leader in the scope of a Multi-Asset SAAS Solution. Offering a wide coverage of futures exchanges and metals clients can price multiple securities and dates

This new solution offers the ability to cross each contract against a different FX Forward (example wheat front month in JPY), helping clients to reduce cost and improving P&L by pricing metals and commodities in the local currency and a single transaction. The settlement date of the forward is chosen as the selected commodity contracts maturity date.

Plug into any of the major exchanges or trade directly OTC via Celer.

For agricultural contracts the tile can trade in different units

e.g. Lots, Bushel and MT, to suit different user needs.

Manage the Price.

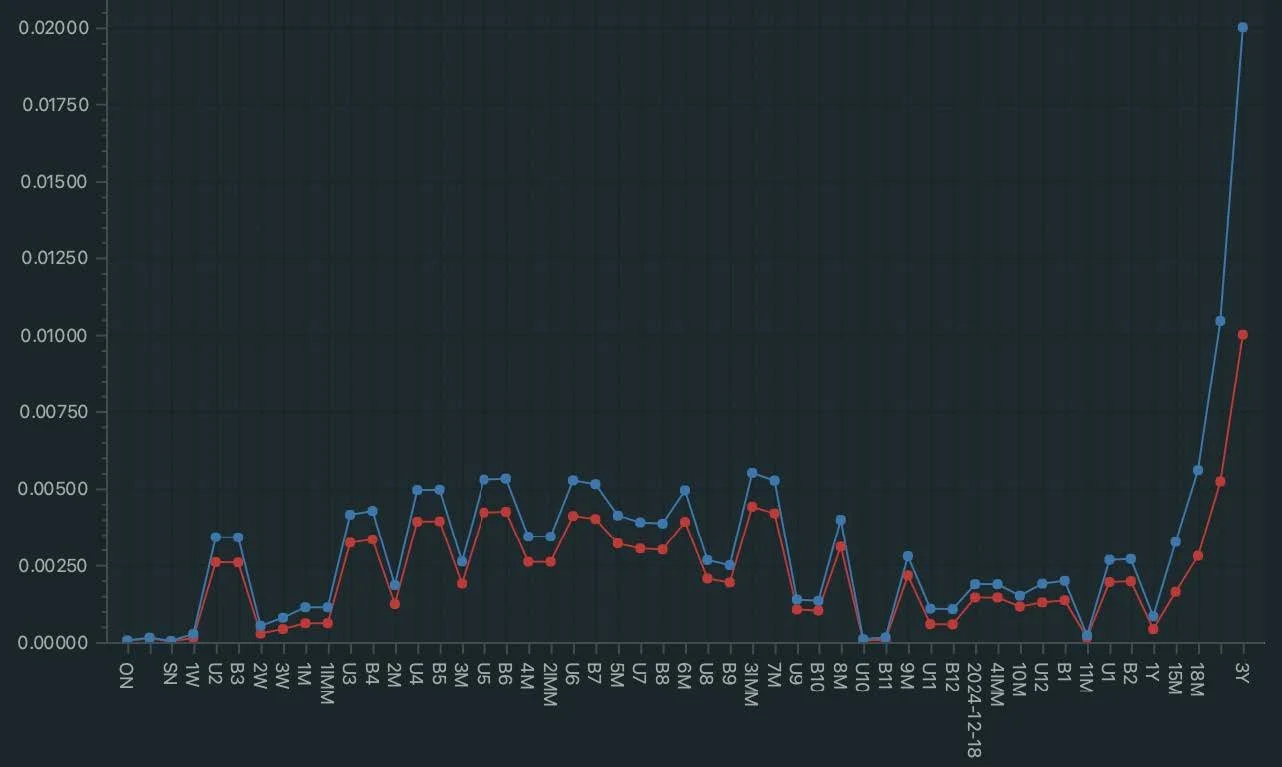

All with an integrated Forward Curve to better compose commodity prices around those longer dated contracts.

And for those that seek to fully automate their risk, Celer’s ‘Supervisor’ is the cherry on the top. An automated rules-engine that will monitor in-house risk according to position and/or PnL exposure to help manage and exit risk.

Full Article.

For a more detailed overview, click on the button below and download our PDF.